Many licensed online gaming operators in Ontario now use facial recognition technology to verify players’ identities. This industry-led shift helps meet regulatory standards for security and age verification, but raises important questions about privacy. This article explains how the technology works and what it means for you.

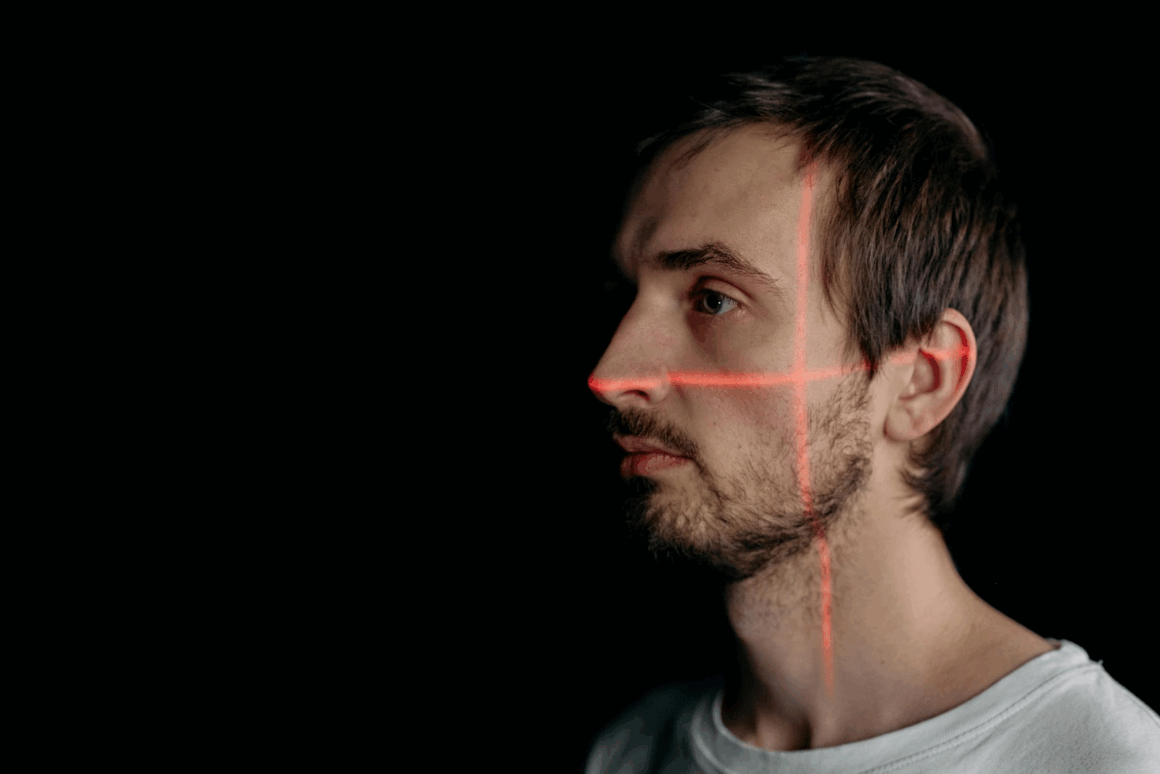

So you’re signing up for a new Ontario online casino account, and suddenly your webcam light blinks on. You’re asked to complete a quick facial scan before you can play. This is happening more often these days as gaming operators search for secure ways to use biometric technology. The Alcohol and Gaming Commission of Ontario definitely keeps tight standards for proving who you are and how old you are. Their Know Your Client rules make sure of that. But here’s the thing. They don’t force operators to use any specific tech. Even so, plenty of casinos have turned to facial verification because it works. It reliably meets regulatory demands while cutting down on fraud and keeping unauthorized users out.

Regulatory Standards Lead Tech Innovation

Canada’s new online casinos are all about making it safer for players and their wallets. Take a look at the AGCO’s Internet Gaming Standard 2.01. It says operators have to verify your identity and confirm you’re 19 or older. In plain language, they need to know you are actually you. And lots of casinos are now using facial scans to make sure. You’ll typically be prompted to take a live video selfie. That clip gets compared to your government ID using special software. And that “liveness” check is there to confirm you’re real and present, not just a photo or a recording.

It’s not just provincial rules driving this shift. Federal regulations play a big part too. The Financial Transactions and Reports Analysis Centre of Canada, better known as FINTRAC, sets anti-money laundering rules that include identity checks for certain transactions. Their approach is pretty open. They don’t push any single technology, but they do demand reliability. That flexibility nudges operators toward robust options like biometric verification, even if it’s not strictly required.

Why Operators Choose Facial Verification

Facial verification does a lot of heavy lifting for casinos. It stops underage players better than old school methods. It blocks fraudsters trying to use stolen IDs. And it seriously improves self exclusion programs. How? By creating a unique biometric template that locks out people who’ve chosen to ban themselves, even if they try signing up again with a different email.

Operators also use this tech to keep an eye on player behavior. It can pick up changes in your typing rhythm or betting patterns that might signal trouble. If something looks off, the system might suggest you set a deposit limit or just take a breather. That kind of proactive care aligns perfectly with what regulators want: safer, more responsible gambling.

Privacy Considerations for Biometric Data

Then there’s the privacy side. Biometric data isn’t just another username. It’s deeply personal. Canadian law, including PIPEDA, treats it as highly sensitive. That means operators can’t just sneak it into the fine print. They have to ask meaningfully, explaining clearly what they’re collecting, why they need it, where it’s going, and who might see it.

And you do have a choice, though it’s not an easy one. Provide your biometrics, or skip playing on most regulated platforms. But once your face is scanned, that’s it. You can reset a password. You can cancel a credit card. But you can’t change your face. That’s why how these companies handle your data matters so much. Strong security isn’t optional. It’s everything.

Industry Standards for Data Protection

So what are the best operators doing? For starters, they’re encrypting everything, both in transit and at rest. They lock down access tight. They run security audits like clockwork. Many don’t even keep your actual photo. Instead, they store a mathematical template, which is pretty useless to hackers. It’s a smart way to reduce risk without losing functionality.

Data retention policies are evolving too. Most delete the original facial scan right after creating the template. Inactive accounts get wiped automatically. Industry groups are pushing for consistent standards because everyone benefits when players feel safe.

Biometric Verification in Gaming

What’s next? Maybe continuous authentication, where the system checks in during your session to make sure it’s still you. Or multi-modal biometrics mixing facial recognition with voice or behavior patterns. As these tools get smarter, regulators will pay closer attention. Ontario’s casinos aren’t just watching. They’re helping shape the conversation, trying to balance innovation with respect for your privacy.

Balancing Security and Privacy

Let’s be clear. No one’s forcing facial verification by law. This is the industry stepping up to meet, and even exceed, regulatory expectations. But as adoption grows, transparency is non-negotiable. Players need to trust the tech, or they’ll walk away.

Will it work? That depends. Companies that are open about their practices and ruthless about security will keep player confidence. Those that cut corners will face angry users and stiff penalties. Right now, the industry is still learning and adapting, still trying to figure out how to protect you without overstepping. And that’s a balance worth getting right.